05.15.25 By Aditya Arora

Banks are caught in a tug-of-war between the future and the past. Customers want speed, personalization, and effortless service at every touchpoint. Regulators demand stricter compliance and transparency. But here’s the problem—behind the sleek apps and friendly chatbots, many banks are still weighed down by outdated legacy systems and inefficient processes. It’s time to address what’s really holding the banking industry back.

Middle and back-office operations like onboarding, servicing, credit processes, and dispute resolution might not be as visible as front-end apps, but they play a critical role in shaping customer experience. And the stakes are high— a study found that over 55% of end customers will leave their bank because of poor service or slow resolution time.

Another revealed that 80% of banking end customers use more than two channels to start and end a service request and end up giving up, expecting that the bank knows them and their needs. On the surface, things may still function. But as competition intensifies and expectations grow, the real risk is no longer just technical—it’s operational credibility. And no amount of front-end polish can fix that.

True transformation starts where customers don’t see it—but feel it. Through seamless onboarding, proactive service, and credit reviews that don’t vanish into someone’s inbox. That’s why banks aren’t just rethinking what they automate, they’re rethinking how they do it.

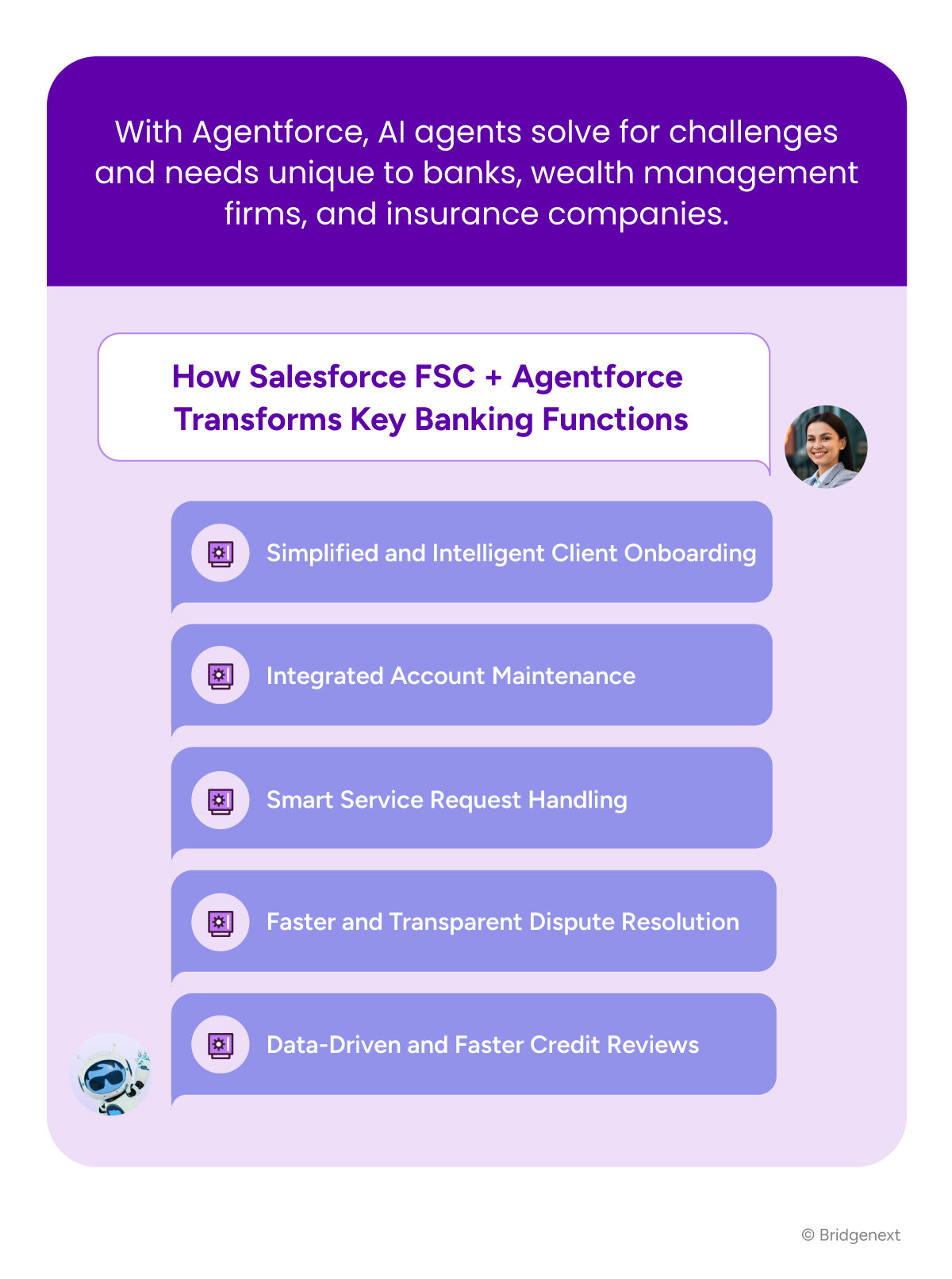

With Salesforce Financial Service Cloud (FSC) as the foundation and Agentforce agentic AI enhancements layered on top, operations go beyond faster. They become smarter, more adaptive, and ready for the future. This is automation that thinks. It’s the shift no one talks about—but every bank needs.

Here’s how intelligent automation powered by Salesforce FSC + Agentforce transforms key banking functions:

Onboarding should set the tone for a trusted client relationship, but for many banks, it’s a source of frustration. Siloed systems and manual processes create bottlenecks, forcing new customers to wait days or even weeks. FSC digitizes client onboarding, while Agentforce simplifies workflows and data connectivity. For example, AI-driven systems can validate documentation in real-time, flag errors, pre-fill customer forms using existing data, and suggest next-best actions for advisors.

Impact: Seamless workflows that reduce onboarding times by up to 40%, ensuring advisors spend more time building relationships, not chasing paperwork.

Customer data is dynamic, and managing updates manually is not only time-intensive but prone to errors. FSC facilitates seamless updates through self-service portals, and Agentforce can synchronize the data across all internal and customer-facing systems. By pulling insights from disparate systems without complex integrations, updates are faster, more accurate, and actionable.

For example, AI models can predict when additional prompting might be needed for items like KYC updates and detect gaps that could pose compliance risks.

Impact: This enhanced synchronization improves advisor productivity by around 30%, helping banks operate with speed and precision.

Updating an address, reissuing a lost debit card, or processing account queries shouldn’t require multiple handoffs or extended delays. Traditional automation might route these requests effectively, but Agentforce can take it further, prioritizing cases based on urgency, analyzing customer sentiment to prioritize escalations, and even generating automated summaries for customer-facing advisors.

With FSC and Agentforce, service requests automatically adapt to SLA thresholds and proactively raise flags for exceptions.

Impact: Banks have reported a 50% decrease in repeated escalations, improving customer satisfaction significantly.

Disputes are a critical moment of truth in any banking relationship. Customers expect swift and fair resolutions. Automation ensures basic workflows are in place, but Agentforce transforms disputes into opportunities for customer engagement by:

Impact: Banks using Salesforce FSC and Agentforce solutions report 60% faster dispute resolutions and higher transparency, leading to improved customer retention and stronger trust.

Manual, document-heavy credit reviews are time-consuming and riddled with inefficiencies. FSC integrates with credit bureaus and rule engines to digitize the evaluation process, but it’s Agentforce that enables smarter credit decisions. Using predictive analytics, AI systems evaluate creditworthiness based on hundreds of data points, reduce decision times, and surface opportunities for portfolio diversification.

Impact: This means loan approvals and credit servicing are not just faster but much more consistent, yielding a 40% improvement in cash flow and customer retention rates.

What sets Agentforce apart is its adaptability. Unlike traditional AI-powered automation tools that are task-focused, Agentforce is designed to learn continually and integrate insights across systems without the need for complex IT architectures. It uses natural language processing and an LLM to search Salesforce records and surface helpful responses, saving agents time and improving customer service. With smart follow-up suggestions and clear explanations, this digital agent can quickly provide answers without digging for information. It identifies patterns, analyzes gaps, and ensures every workflow functions as part of a seamless operation.

Its unique ability to generate actionable summaries, identify emerging trends, and recommend the next steps ensures that front-line teams, office managers, and C-suite executives always operate with clarity and confidence.

While Salesforce FSC is a foundational platform for scaling and automating operations, adding Agentforce creates an entirely new paradigm of capability. Together, they empower banks to do more than just digitize existing workflows; they enable true transformation by enhancing decision-making processes and creating systems that adapt as needs evolve.

However, transformation isn’t just about technology. Your bank’s success depends on implementing these tools strategically, ensuring they complement existing processes, integrate seamlessly with other systems, and gain widespread adoption among teams.

At Bridgenext, one of only two official PDOs for Salesforce, we bring unmatched expertise in Financial Services Cloud (FSC) and Agentforce. Our in-depth understanding of the platform—paired with 50+ pre-built process templates that go beyond what FSC offers out-of-the-box—helps banks accelerate the build and launch of automated processes, simplify customer experiences, and boost banker productivity. Our expertise includes:

If your institution still relies on manual processes or fragmented systems, now is the time to leap forward. By combining Salesforce FSC with Agentforce’s capabilities—and Bridgenext’s industry-aligned accelerators—you’re not just automating; you’re redefining how your bank operates and engages customers.

Don’t wait to modernize. Schedule a tailored FSC + Agentforce workshop with Bridgenext today and unlock new levels of efficiency, intelligence, and customer loyalty.