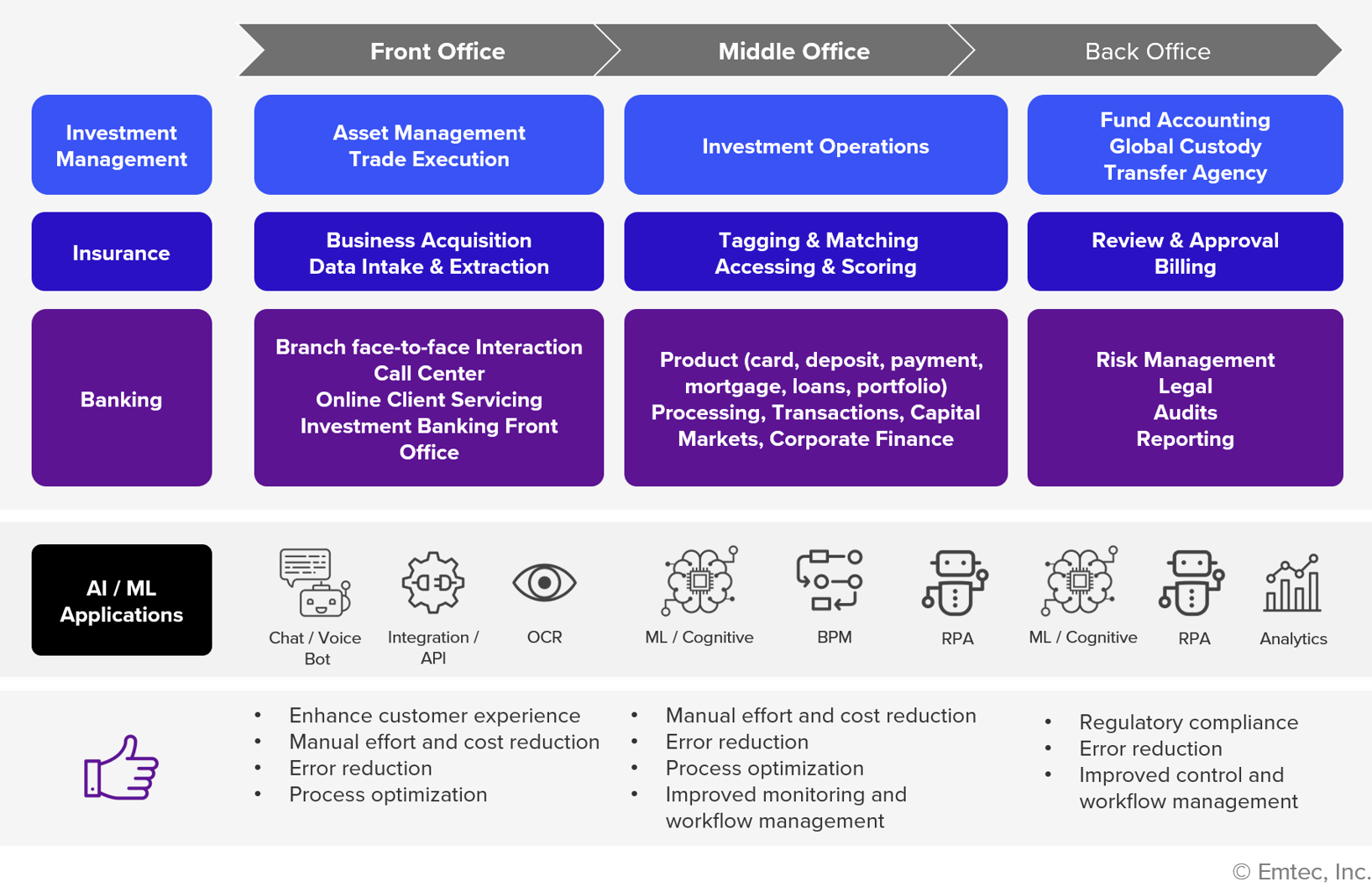

Advancements in data technologies and affordability of Machine Learning (ML) and Artificial Intelligence (AI) tools have reshaped the financial services industry like never before. Leading banks and financial services firms are deploying advanced technologies to streamline their processes, optimize portfolios, decrease risk and underwrite loans amongst other things.

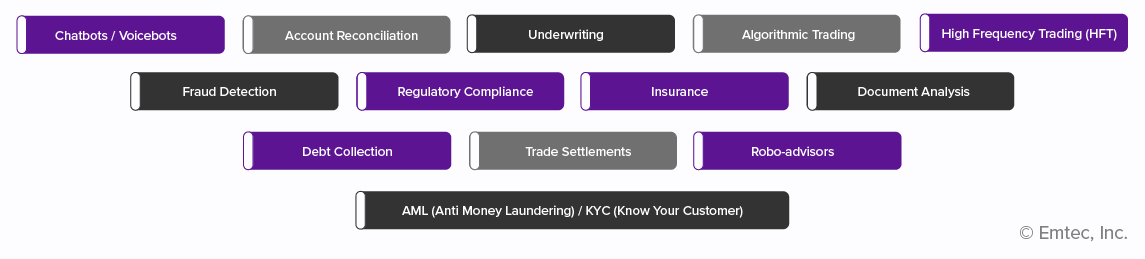

Critical applications of Machine Learning in financial services

There are several financial applications where Machine Learning can provide exponential value. A few examples are listed below.

- Chatbots / Voicebots

With robust Natural Language Processing (NLP) engines and the ability to learn from previous interactions, ML-based chatbots can quickly and accurately resolve customer queries without callbacks. These chatbots, available 24X7 with no wait time, can rapidly adapt to individual customer needs and changes in customer behavior.

- Fraud Detection

Fraud prevention is becoming more complex with the mass adoption of e-commerce, increased cross-border payments, and the growing popularity of new digital payment methods. With Artificial Intelligence and Machine Learning, service engines such as Nets Fraud Ensemble can help reduce fraudulent transactions by up to 40%1. AI for fraud detection can also reduce the workload of security operations teams – like it did for DX Bank . McAfee estimates that cybercrime, of which financial fraud is a component, now costs the world around $600 Billion, equating to 0.8 percent of the global GDP . Examples include stolen identities, credit card fraud, fraudulent account takeovers, new account fraud, fraudulent insurance claims, or false positives. Hackers use AI and ML to methodically work their way into financial services networks. Fighting fire with fire, banks use AI and ML for fraud detection and prevention.

- Underwriting

With terabytes of data and document capture technologies (i.e. invoices, paychecks, annual reports and cash flow statements), ML and NLP can do wonders for the applicant evaluation process by identifying anomalies and detecting patterns to determine if an applicant is eligible for a loan or insurance. These applications can provide a percentage of associated risk regarding repayment and potential for fraudulent claims.

- Insurance

Artificial Intelligence can assess customer risk profiles to generate a quote for the best insurance plan. This automation reduces front-end sales costs and improves customer satisfaction. Claims processing can also be optimized with AI. Accident images can be analyzed and repair costs estimated in real time. It can further detect fraudulent claims and check whether claims meet regulations. For example, insurance leader AXA recently rolled out three AI bots: Lenny, Bert, and Harry, as part of their customer and commercial property team. These bots take care of routine repetitive tasks, enabling their employees to focus on more analytical issues. The three bots are expected to save them over 18,000 man-hours per year .

- Robo-Advisors

An online automated investment management service uses computer algorithms to build portfolios and manage asset allocation based on risk appetite and investment objectives. Their clients benefit from a wealth of services provided at a lower cost! Some of the leading robo-advisors of 2019 include Wealthfront, Ellevest, allyinvest, Betterment, Personal Capital, Sofi Automated Investing, Bloom, and Nutmeg.

- Debt Collection

AI can contribute in efficient debt collection process. According to the CEO of Brighterion, a MasterCard company, effective use of AI can help reduce delinquency rates by around 76% .

- Account Reconciliation

Leveraging AI, bank account data can be extracted to compare with complex spreadsheets to accelerate account reconciliation and to eliminate errors.

- Regulatory Compliance

AI with NLP can scan through legal and regulatory documents to detect irregularities without any manual intervention or error and with more speed.

- Algorithmic Trading

Algorithms are used in hedge funds, (based on parameters such as timing, price, quantity etc.) to auto execute programs with a predetermined set of instructions for placing a trade. Algorithmic trading enables the execution of a large order by sending small increments of the order, called ‘child orders’ to the market at intervals. In 2018, over 50% of the 20 top-earning hedge fund traders and managers were associated with computer-driven algorithmic trading. Renaissance Technologies, one of the top hedge funds, has long been at the forefront of deploying machine and deep learning tools in trading. Other leading hedge funds including BlueCrest Capital Management, Bridgewater Associates, Citadel LLC, etc. also use ML and deep learning for trading.

- High Frequency Trading (HFT)

High Frequency Trading (HFT) is basically algorithmic trading that occurs at high speeds beyond human capability – hundreds of thousands of trades per day executed by complex algorithms that analyze multiple markets to execute orders based on prevalent market conditions. Most pension funds, hedge funds, mutual funds and investment banks use HFT. A few of the biggest HFT players are companies such as Virtu Financial, Tokyo-based Nomura Securities, Citadel Securities, Two Sigma Securities, DRW and Tower Research Capital.

- Document Analysis

With deep learning and image recognition, scanned documents can be used for further analysis. At JP Morgan, a program called COIN (Contract Intelligence) uses ML to interpret documents. ML systems can scan and analyze legal as well as other documents with great speed, helping banks meet compliance mandates and combat fraud.

- Trade Settlements

Trade settlement is the process of transferring securities into the account of a buyer and cash into the seller’s account following a stock trade. BNY Mellon has implemented robotic process automation software that allows them to perform research on failed trades, identify the problem, and fix any found issues.

- AML (Anti Money Laundering) / KYC (Know Your Customer)

Through image recognition and NLP, companies can enhance their KYC process for new client onboarding with improved speed. The ability to investigate through a vast array of external data sources leads to improved client onboarding experiences. ML can be trained to extract risk-relevant facts from huge volumes of data, making the process of identifying high-risk clients faster and easier.

Some real-life use cases of AI in banking and insurance

Leaders in banking and insurance have already started AI implementations across their organizations.

- ICBC, the largest bank in the world (in terms of assets) provides mobile banking with its robo-advisor branded “AI Investment”, “e-Mortgage Quick Loan” and “Tax e-Loan” services. In recent years, ICBC has accelerated their in-depth integration of digital via enterprise-level FinTech platforms based on AI, biometric identification, Blockchain and the Internet of Things (IoT). For those that do wish to converse with a human, private rooms can be reserved for remote chats with client relationship managers via a video link. ICBC also has SME risk management solutions from Pintec for its micro- and small-sized (“SME”) lending business, further enhancing the effectiveness of its lending services for SME clients . With the Covid pandemic resulting in high demand from SMEs for financial support, these services are proving to be very helpful.

- China Construction Bank (CCB), the second largest bank in the world has opened a branch in Shanghai staffed almost entirely by robots brimming with AI, Virtual Reality (VR) and Facial Recognition (FR) technology. Aside from a few security guards, the branch employs no human staff during opening hours. According to CCB, the new format can handle 90% of the cash and non-cash demands of traditional banking outlets.

- Mitsubishi UFJ Financial (MUFG) is a Japanese financial services and holdings bank ranked 5th on S&P Global’s list of the top 100 banks, and the largest Japanese bank on the list. MUFG has begun several new projects pertaining to their data infrastructure and the use of AI in the enterprise – including deep learning and NLP for credit assessment and predicting investment outcomes based on risk estimates. It plans to use the technology for wealth management and credit assessment.

- JP Morgan Chase, the biggest bank in the United States and ranked amongst the world’s top five banks, has already implemented cloud, AI, and ML features in various banking activities to prevent and detect risk of fraud; to sniff out malware. In their hedge fund services, Algo Central is a trading platform designed to allow clients to use predictive analytics to tailor orders and change the speed and execution style while the trade is live with DeepX leveraging ML to assist the equities algorithm. The bank has also signed a five-year deal with Persado to implement AI into its marketing strategies across the enterprise. Lastly, the U.S. government recently launched the Paycheck Protection Program (PPP) in response to the COVID-19 crisis, which has increased the volume of applications for banks. Chase uses AI and NLP for faster document sorting to enhance underwriters’ ability to process these applications, getting customers their loans faster2.

- HSBC is the first financial institution to use AI as a method for equity investing. The bank uses AI and data analytics for various operations such as:

- AI-based iCash tool for data-driven forecasting of cash withdrawals at ATMs, facilitating more accurate and efficient replenishment

- Data analytics to decide where to set up a new branch by analyzing data about customer shopping and travel patterns. This has been especially useful during the coronavirus pandemic to develop a dashboard that directs customers to use nearby open facilities.

- Bank of America has already adopted AI, ML and NLP for various processes including predicting potential corporate loan defaulters, a virtual financial assistant named Erica and predictive analytics applications.

- Citibank launched its own fraud detection software in 2019. Citigroup has also deployed an intelligent virtual agent (IVA) in its call centers, which is a blend of AI and predictive technology (a part of ML).

- Leading insurer AXA deployed a field humanoid robot “Pepper” to assist in its Singapore location. Aside from Pepper, AIA Singapore has also deployed a homegrown humanoid, robot “Nadine”, to its Tampines customer service center. Both socially intelligent robots perceive emotions and adapt their behavior based on customer response. AXA has also enabled voice assistance to help customers during out-of-office hours. AXA Research continues to invest in projects that foster trust in AI through research.

- ING Group uses predictive analytics for bond trading. It also uses AI in all their customer relationship centers in the Netherlands for automated email management processes. The group is also investing in AI-driven compliance through the company Ascent.

- Fannie Mae, one of the largest mortgage companies in the US, has cut down the number of monthly IT support issues by a third by implementing an AI tool developed by Moogsoft Inc. The tool uses ML to analyze technical problems by tracking patterns and anomalies, isolating the causes of crashes or other malfunctions, and suggesting a course of action.

The trend continues

Per IDC, global spending on AI systems in the banking sector was anticipated to exceed $5 Billion in 20193 for AI-enabled solutions including automated threat intelligence and prevention and fraud analysis and investigation. IHS Markit forecasts the actual business value of AI in banking worldwide to reach $300 Billion by 2030.

If the examples above are any indicator, AI and ML will continue to revolutionize the financial services sector. Those who invest will gain exponential dividends. Those that don’t will be left behind. Where are you on your journey?

Contact Bridgenext today to get started.

References

- https://assets.kpmg/content/dam/kpmg/dk/pdf/dk-2020/04/Nets-KPMG-Fighting-Fraud-with-a-Model-of-Models-whitepaper-2020.pdf

- https://venturebeat.com/2020/07/15/how-chase-is-using-ai-to-update-banking/

- https://www.idc.com/getdoc.jsp?containerId=prUS45481219