Challenge / Goal

A financial software leader that serves the nonprofit sector wanted to remove outdated hardware systems, and implement digitization to accelerate and streamline payment processing and deposits.

Recognizing legacy systems slowed down processes, reduced productivity and increased technical debt, the company reached out to Bridgenext (formerly Emtec Digital) to improve efficiency and overcome challenges including:

- Limited access for branch managers due to hardware-dependent systems

- Inability to track member status

- Absence of a channel to accept/send money through checks

- Lack of mobility in payment processing

- Inability to track members’ pending dues

The company wanted to build a comprehensive mobile application compatible with every OS. The primary goal was to upgrade their existing payment processing system and tackle the complexities faced by their branches available in different locations. They expected this application to enable a smooth anywhere, anytime payment process.

Solution

Our team first focused on learning more about the organization’s existing payment process and finding the right technology to develop while leveraging existing backend systems. Our goal was to automate as many tasks as possible with digital technologies.

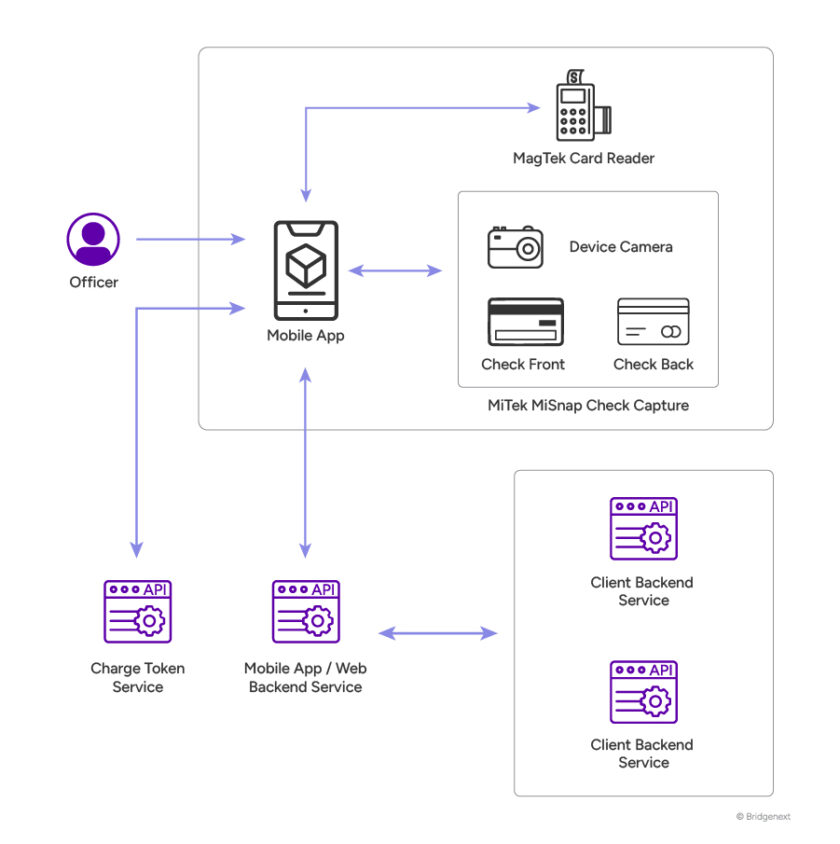

We successfully developed an app for iOS and Android built on the React Native framework. The app was released with automated mobile image capture technology, instant check processing and many more features.

With the new mobile app, the client can easily and securely accept payments, deposits and donations from members and branches. The simplified nature of card and check payments has enabled the client to offer valuable benefits to their end clients including:

- Remote access to send and receive payments effectively

- Seamless integration with members’ accounts to simplify payments

- The ability to accept donations as part of fundraising campaigns

- Secure scanning and submission of mobile deposits to respective branch accounts

Tech Stack

- .NET Core

- React Native

- Firebase

- Mitek

- MAGTEK

- Application Insights

Results

The mobile app benefitted members and branches in various ways:

- In-person member payments

- The app enables branches to accept in-person member payments, collect donations and submit mobile deposits

- It accepts MasterCard®, Visa®, Discover® and AMEX® credit card transactions.

- Integrated solution

- Reduced risk of tax penalties

- Provision of meaningful data from client reports

- Secure transfer of funds to a branch account in minutes

- Well-managed fundraising campaigns

- Easily trackable campaigns for focused fundraising efforts

- The ability to accept payments, fees, donations and deposits at fundraising/charity events

- Direct payments via multiple payment modes at event venues

- Nationwide tracking of branch transactions and membership status

- Improved success rate for fundraising events and campaigns