09.04.25 By Bridgenext Think Tank

The banking industry faces a staggering reality: the top 15 U.S. banks alone spend $3 billion annually processing disputed transactions. With digital payments projected to surge from $3.5 trillion to $20 trillion globally over the next eight years, this cost crisis is accelerating rapidly. But innovative banks are discovering a powerful solution through AI and automation.

Our recent webinar, “Future of Banking: How AI & Automation are Transforming the Customer Experience Highlight on Disputes,” revealed strategies that modern institutions are using to transform their dispute resolution processes. The insights shared by industry experts demonstrate how artificial intelligence isn’t just reducing costs, it’s revolutionizing the entire customer experience.

The current state of dispute management in banking presents a compelling case for transformation. Consider these eye-opening statistics from our webinar discussion:

These numbers paint a clear picture: traditional approaches to dispute resolution will be unsustainable. Banks have historically responded to growing dispute volumes by adding more personnel and implementing additional point solutions, creating a fragmented ecosystem that delivers a poor customer experience and escalating operational costs.

The complexity of modern dispute resolution extends far beyond simple transaction reversals. Today’s process involves multiple interconnected systems, from core banking platforms to card network integrations, like Mastercard and Visa. Customer service representatives must navigate this maze of systems while maintaining compliance standards and delivering exceptional service, a nearly impossible task when dealing with time-sensitive, emotionally charged customer interactions.

The result? Customers experience frustrating delays, inconsistent communication, and lengthy resolution times. Meanwhile, banks struggle with operational inefficiencies, compliance risks, and mounting costs that directly impact their bottom line.

During the webinar, AI-led digital assistant solutions for dispute management were highlighted with three core principles:

Traditional systems force agents to hunt for relevant information across multiple platforms. AI-powered solutions flip this model by proactively delivering the right data at the right moment. When a dispute is initiated, intelligent agents immediately surface critical information including:

This approach eliminates guesswork and dramatically reduces resolution times while improving decision quality.

Digital AI assistants like Agentforce excel at coordinating complex workflows that previously required significant manual intervention. The webinar demonstration showcased how these systems can:

This automation doesn’t replace human judgement; it enhances it by handling routine tasks and surfacing critical insights for human decision-making.

Rather than requiring banks to replace existing systems, modern Data analytics and AI solutions integrate with established infrastructure to create seamless experiences. The webinar highlighted successful integrations with major card networks and deflection tools that can prevent up to 25% of disputes from progressing to formal resolution processes.

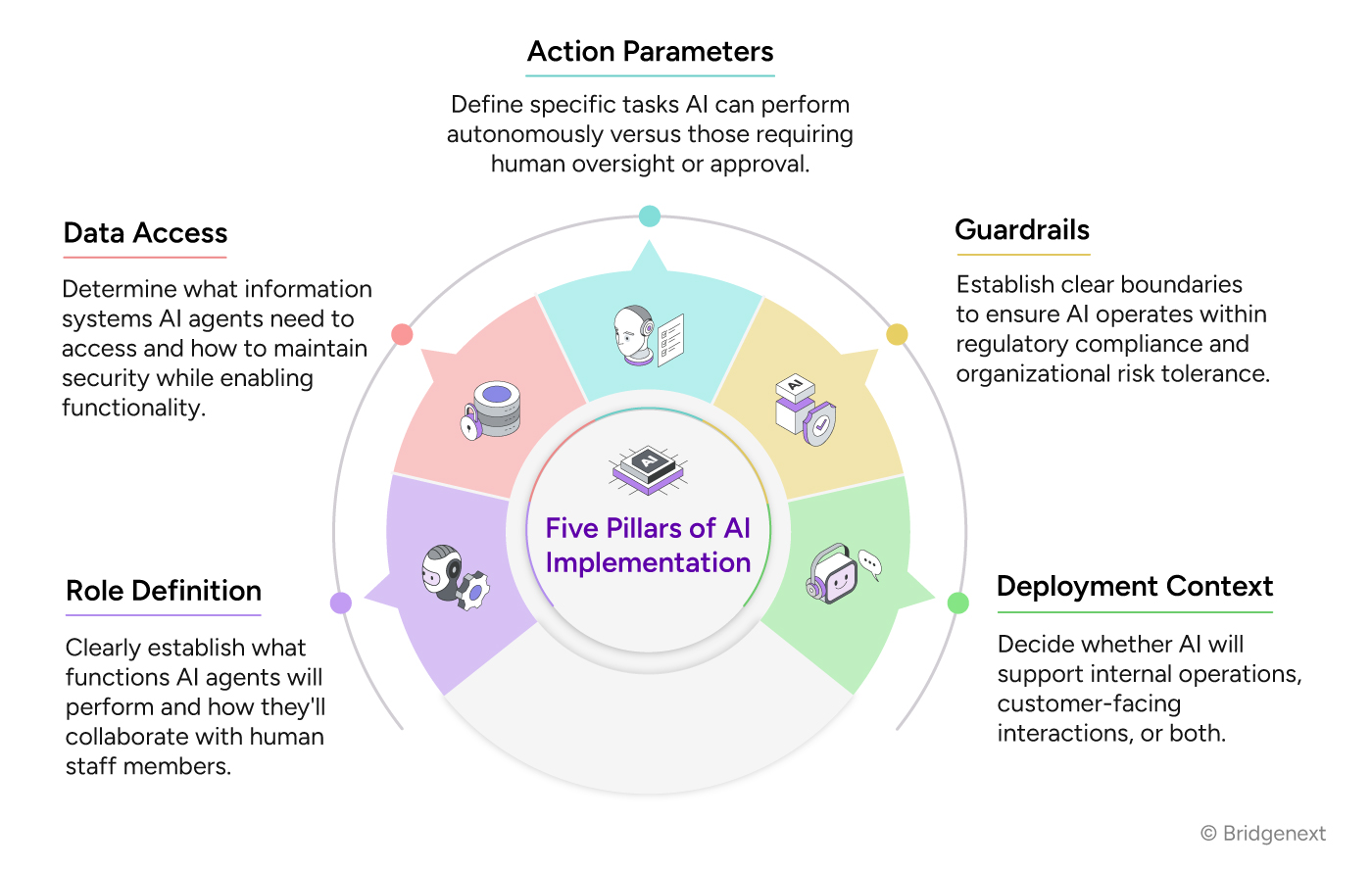

Banking leaders considering AI implementation should focus on these five critical elements:

The webinar emphasized that starting small and scaling gradually is your best bet. Most successful implementations begin with low-risk, high-value use cases such as:

These foundational capabilities build organizational confidence while delivering measurable improvements in efficiency and customer satisfaction.

Banks that embrace AI-powered digital assistants for dispute resolution gain significant competitive advantages:

Banks are already experts at managing complex operations but rising volume and additional customer demands require new ways to simplify processes and maximize impact. Our recent webinar on dispute management shows how AI-led digital assistants are not just improving dispute resolution, but also driving efficiencies across account maintenance, compliance, and customer service.

With insights from industry leaders, banks are seeing faster resolution, lower costs, and higher customer satisfaction, while staying compliant and boosting workforce productivity. What makes Bridgenext different is our proven experience and consultative approach: we don’t just implement tools; we guide you in applying AI where it creates measurable business value and sustainable impact.

AI-powered dispute resolution isn’t a “someday” solution, it’s a powerful way to deliver more value and reduce your risk now. The banks that move quickly will set the standard for tomorrow. Watch the full webinar to learn the practical strategies, see the live demo, and get expert guidance on how to start your AI journey with confidence.

Ready to turn operational challenges into a competitive edge? Schedule a conversation with our team to map your AI journey today.