It is not uncommon today for customers to interact with a bot instead of an actual human representative to get their questions and concerns resolved. This wave of automation is taking over many industries – including banking and fintech, delivering substantial impacts on customer service functions.

According to Gartner1, organizations that implement a Virtual Customer Assistant report up to a 70% reduction in call, chat, and/or email inquiries. With these advantages, it’s no surprise that usage of self-service bots and virtual assistants is on the rise like never before.

In fact, simple FAQ or rule-based bots are now being replaced by next-generation bots using advanced AI, NLP, and ML technologies. Smart bots, aka conversational bots, are practically running customer service functions for most digital banking platforms

According to a Facebook2, 53% of people would prefer to message rather than call customer service.

Over and above the benefits of shorter waiting times, quicker responses, more personalized experiences, and enhanced user preferences, here are some additional reasons firms are choosing conversational bots for their dedicated customer service agents –

- 24/7 availability

- Elimination of human errors

- Enhanced compliance, efficiency, and productivity

- Speedy issue resolution

- Scale up and down based on the demand

Ambitious organizations in the banking and financial services industry are investing in context-aware bots that leverage a conversational user interface (CUI) for enhanced customer experience and support. Besides being super-efficient, these bots help banks to gain tangible operational and financial benefits.

A Juniper Research survey3 states – nearly 90% of bank interactions (internal and external) are automated through AI chatbots. Also, the operational cost savings using chatbots in banking will reach $7.3 billion globally by 2023, up from an estimated $209 million in 2019.

Organizations that integrate a conversational bot into their customer service applications make optimal use of their human and digital resources and transform their customer and employee experience for the better.

As stated by PwC4, the consumer mindset has shifted in today’s fast-paced world, with the demand for immediate satisfaction and convenient resolution of queries in all brand interactions.

Consumers are willing to pay a nearly 16% premium to businesses providing superior levels of service.

Types of Bots

So, we know the demand is there for this technology. But what are the different types of bots to consider?

-

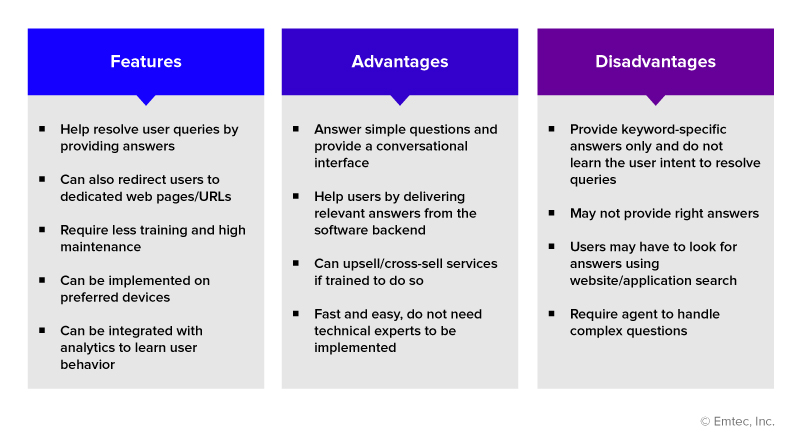

FAQ Bots

As an automated support system, FAQ bots answer simple user questions with a conversational interface. They can provide yes/no or brief answers to simple user questions. As entry-level bots, they bring answers to your users rather than them needing to search for a dedicated FAQ page to look for answers themselves.

-

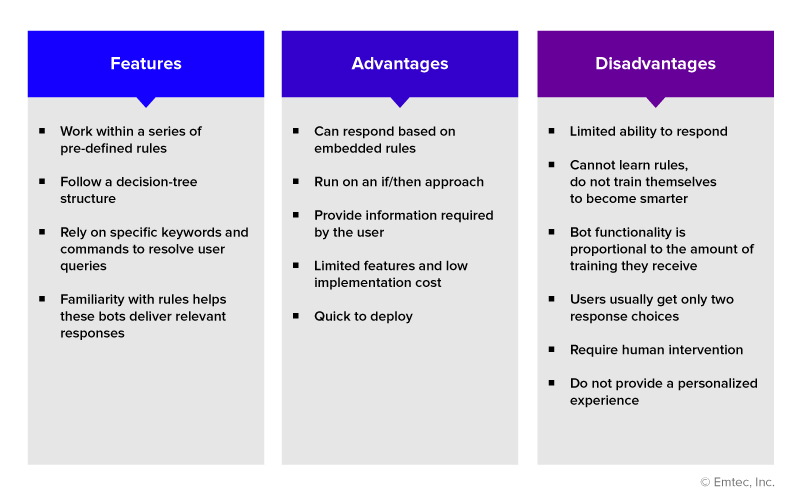

Rule-based Bots

Rule-based bots, also called decision-tree bots, are simpler than AI bots in terms of technological advancement and implementation. Since they do not require modern features but work on flow-based designs and predefined outcomes, they are easier to develop and implement. Here is an overview of the main features, benefits, and shortcomings of rule-based bots –

-

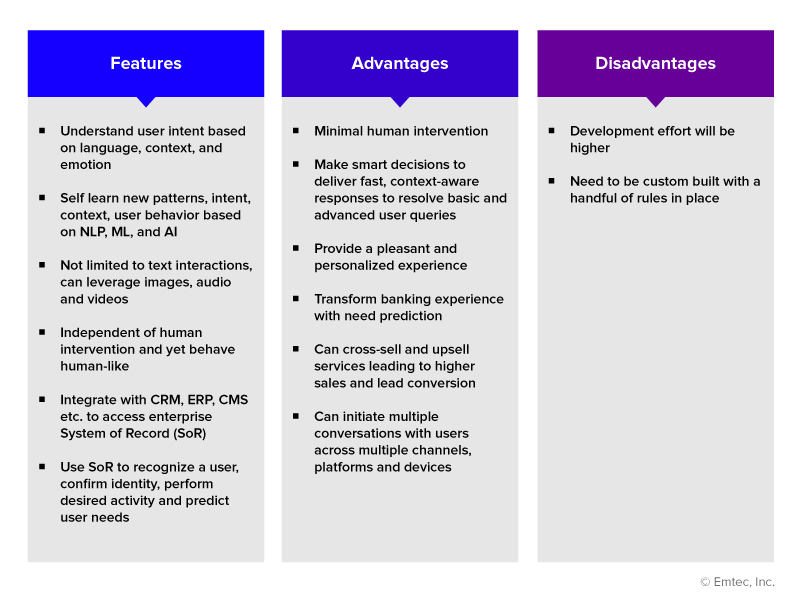

Context-aware bots

Context-aware bots are smart bots, powered by AI, ML, and NLP. By accessing the enterprise’s system of records, these bots recognize users, remember their behavior history, act as virtual assistants, and provide a human-like personalized experience. They provide the most value as they can identify, learn, and respond to user intent to deliver faster and better query resolution.

Context-aware Bots

The context-aware bot makes the process much easier with:

- Clarity in deciphering user needs for accurate responses

- Eliminate unnecessary data inputs which might lead to errors

- No unnecessary ‘introductory questions’

- Proactive next steps or solution offerings

- Quicker resolution

- No human intervention

- Secure and pleasant banking experiences

Here are other interesting use cases of deploying AI-based contextual chatbots –

Scenario 1

Scenario 2

In Scenario 1, Banko knows that the Mastercard that has reached the user. It proactively asks the user if he/she wants to activate and start using it. After activating the card, Banko can provide support on its usage as well.

In Scenario 2, Banko helped the user resolve his/her query by being smart and context-aware. With the ability to access pertinent enterprise systems of record and historical data, the bot was able to prompt the user to select the right amount and accordingly raise a dispute.

Getting started with context-aware bots

Context-aware bots empower organizations to deliver unparalleled customer service and transform their customers’ banking experience. Trained to be self-taught, these bots leverage historical and real-time data to deliver accelerated and accurate human-like responses. Banks can employ these bots to help simplify banking interactions for their customers including –

- Making payments

- Checking bank balance

- Applying for loans

- Transferring funds

- Accessing and downloading bank statements, credit card reports, bills, etc.

- Reporting fraudulent activities

- Blocking a lost or stolen card

- Issuing new cards/check books

- Reminding customers about bill payments/loan repayments

- Sending information on offers, discounts, etc.

- Opening/closing bank accounts

- Resetting passwords for enhanced security

Want to see a smart context-aware bot in action?

Reach out to us to schedule a quick demo, today! Let’s Connect

References

1https://www.gartner.com/en/newsroom/press-releases/2018-02-19-gartner-says-25-percent-of-customer-service-operations-will-use-virtual-customer-assistants-by-2020

2https://insights.fb.com/2016/12/01/messaging-means-business/

3https://www.juniperresearch.com/press/chatbots-a-game-changer-for-banking-healthcare

4https://www.pwc.com/us/en/services/consulting/library/consumer-intelligence-series/future-of-customer-experience.html