05.21.25 By Scott Effler

We can’t overlook how AI and automation have gone from being shiny new toys to absolute must-haves for today’s financial world. Banks and financial institutions are caught in a perfect storm—tightening regulations, customers demanding 24/7 digital services, and more. Add the ongoing tariff wars, global economic instability, and the constant need to do more with less, and it’s no wonder AI-driven transformation is a focus for the Banking, Financial Services, and Insurance (BFSI) industry.

AI is now revolutionizing operations in the BFSI sector, with its ability to boost efficiency, enhance compliance, and deliver hyper-personalized customer experiences. It also plays a critical role in real-time fraud detection and prevention, ensuring greater security and trust. Automation tools, such as intelligent agents, are empowering financial institutions to reduce costs, accelerate innovation, and foster stronger, more meaningful customer relationships, laying the groundwork for long-term success.

In this blog, we highlight a specific use case of an agriculture focused lender and how they streamlined operations with Agentforce. We will also explore several real-world use cases that showcase the broader impact of AI and intelligent agents across customer service, sales, marketing, compliance, and beyond.

We’ve come a long way from traditional Robotic Process Automation (RPA). In today’s hyper-digital world, customers expect instant, seamless service—and internal teams can no longer afford to be slowed down by manual handoffs, siloed systems, or inconsistent data.

That’s why Agentic AI is the next logical step. Compared to older automation approaches, Agentic AI is less rigid, more adaptive, and designed to respond dynamically to changing needs. Agentic AI uses networks of agents that learn, adapt and work together – making decisions and improving continuously, much like humans do.

The goal isn’t to rip and replace your existing systems, it’s to embed intelligence exactly where it matters most, elevating operations without massive disruption.

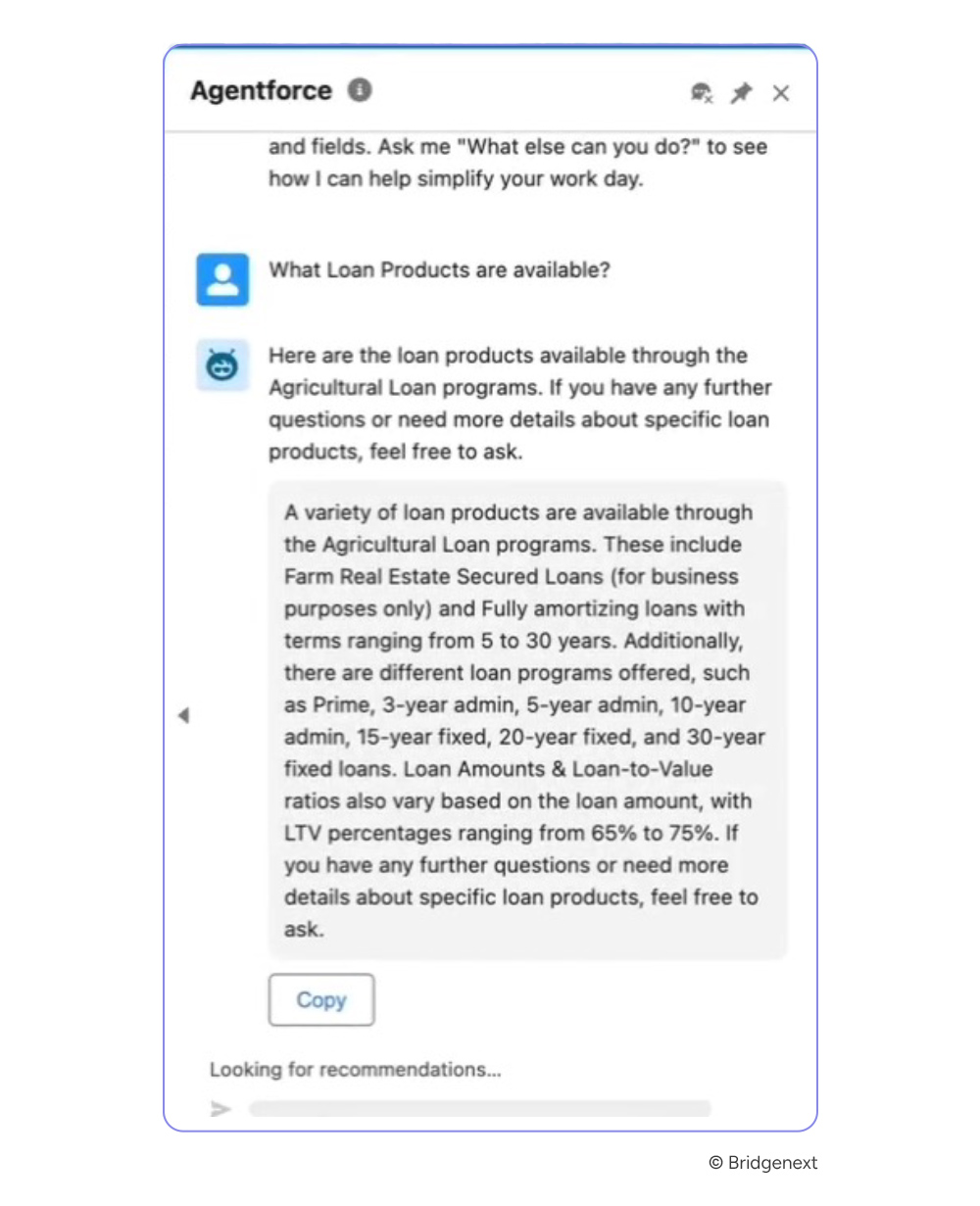

Agentforce, Salesforce’s next-gen Agentic AI framework, is built to do just that. It uses natural language processing and Large Language Models (LLM) to search through data and surface helpful responses for people, saving time and improving customer service. With smart follow-up suggestions and clear explanations, the digital agent can quickly provide answers. It is a great tool in your toolbox to help you level up functions like:

Watch “How AI & Automation are Transforming the Customer Experience in Banking: On Demand Webcast” for more insights. With Agentforce, Financial Services firms can weave better intelligence into the systems they use on a daily basis —driving maximum impact.

Now, let’s take a closer look at how a farm credit cooperative specializing in agricultural lending leveraged Agentforce to transform its operations—delivering smarter, faster, and more reliable service to its customers.

Agriculture lending isn’t your typical loan workflow. It demands managing distributed operations, navigating compliance-heavy evaluations, and supporting relationship managers who are critical to customer trust.

Traditionally, fragmented applicant data, lengthy pre-processing, and limited visibility have slowed everything down—creating frustration for both its employees and customers.

With Agentforce, that’s changed.

Loan officers no longer need to manually parse emails or dig through CRM records or search for loan option information. Agentic AI intelligently scans unstructured inputs, pulls relevant Salesforce data, and prepares pre-filled loan applications for faster turnaround—freeing up teams to focus on judgment calls rather than data wrangling.

But it’s not just about smoother form fills or better dashboards. Agentic AI in banking delivers real, back-office transformation:

The result? A smarter, faster lending process, better employee experience, and stronger relationships with customers.

Building agents can be easy -but ensuring they are effective and sustainable requires much more than just spinning up automation flows.

True success starts with some prep work:

Agentforce isn’t about replacing existing processes or people – it’s about evolving operations intelligently and strategically by combining human-first design thinking with the full power of AI to drive real impact.

This is where having the right partner makes the difference. With Bridgenext, you get a team that not only understands the intricacies of Financial Services firm operations, but also knows how to set up the underlying architecture that makes Agentic AI truly deliver on its promise. If you haven’t already, take a look at our recent blog on how to elevate banking operations using Financial Services Cloud and Agentforce, powered by Bridgenext Process Libraries.

Ready to ideate on how AI can elevate your banking operations? Connect with us.

Reference:

https://www.weforum.org/stories/2024/12/agentic-ai-financial-services-autonomy-efficiency-and-inclusion/