If your digital front door creaks, prospects may ghost you before you even have a chance to pick up the phone. Modern clients expect an online experience as part of your service. In a market where 53% of first-time P&C buyers begin their search online (versus just 29% through agents), clunky clicks and confusing forms can cost you more than a sale—they can cost you the entire client relationship. Every clunky click funnels commission dollars to slick insurtech portals.

Today’s customers blend personal touch with tech—if your agency can’t deliver both, someone else will. Modern buyers expect high-touch advice backed by high-tech execution; nothing turns them off faster than a user experience that feels stuck in the past. The bottom line? Your digital user experience isn’t optional—it’s essential oxygen for your business. Brokers who don’t modernize their web, mobile, and portal experiences risk watching their new business pipeline shrink while tech-savvy rivals sail ahead. In this blog, we’ll outline five digital imperatives that brokers can act on immediately to stay competitive.

Imperative 1 – Self-Service as a Service Differentiator

“Can I pull my COI from my phone?” might sound like an innocent question, but it’s now a litmus test for commercial clients. Today’s policyholders expect on-demand access, and a client portal is essentially your agency’s “digital twin,” ready to serve documents or updates around the clock. In J.D. Power’s latest study, 46% of retained customers now begin with a digital touchpoint, and satisfaction is far higher when all service tasks can be done online.

Without a robust portal, brokers essentially train clients to shop elsewhere. Satisfaction “plummets” whenever customers must abandon digital tools and call the office for routine needs. In other words, forcing clients off online channels undermines loyalty.

Offer a 24/7 self-service portal or app for certs, claims (FNOL), and policy changes. Clients can instantly retrieve their COIs and update coverage on the go. This frees your producers from paperwork – portals “reduce the volume of general service requests, freeing up time for your agents to focus on more complex issues” – so they spend time advising clients, not administering policies.

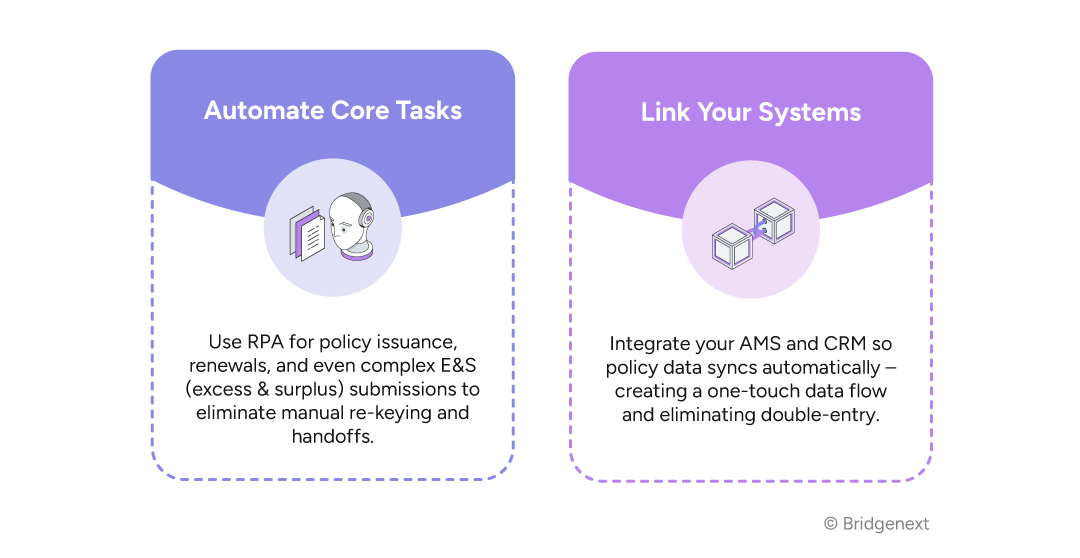

Imperative 2 – Automate Workflows to Protect Margins

Even with 24/7 self-service portals easing admin burdens, brokers still have more to gain by automating core workflows. Every manual endorsement you re-key is free margin for competitors. McKinsey finds automation can reduce the cost of a claims journey by as much as 30%, freeing up cash to reinvest in tech and marketing. Those early adopters are plowing their savings into new tools and growth initiatives, while laggards watch their EBIT slide. Indeed, one study found that digital-first insurers achieved roughly 1–2 percentage points higher EBIT growth than slower peers.

These efficiency gains free up budget to invest in client service. In the next section, we’ll explore how brokers can turn that data into proactive client value using AI-driven analytics.

Imperative 3 – Turn Data & AI into Producer Super-powers

You’ve automated lots of manual tasks, freeing up time and protecting margins. Now use that breathing room for something strategic: turn your data and AI into producer superpowers. Imagine your 10-year loss-run archive predicting next quarter’s churn, if AI could read it. It sounds futuristic, but insurers are doubling down: 89% plan to invest in generative AI by 2025.

Peers and vendors aren’t waiting. Many brokerages now use AI to enrich accounts, score renewal risk, and identify coverage gaps. For example, one report notes AI can “track customer behaviors to remind clients of renewals or coverage gaps [and] suggest policy updates”. That helps catch-up upsell opportunities and keep accounts from slipping away.

Start small but build right. Pilot one high-impact AI use case—say, a renewal-risk scoring project—with rigorous data governance. Industry experts advise: “Identify the data elements most critical for the insight you want and establish data governance”. Use the pilot as a learning lab, then scale up the winners.

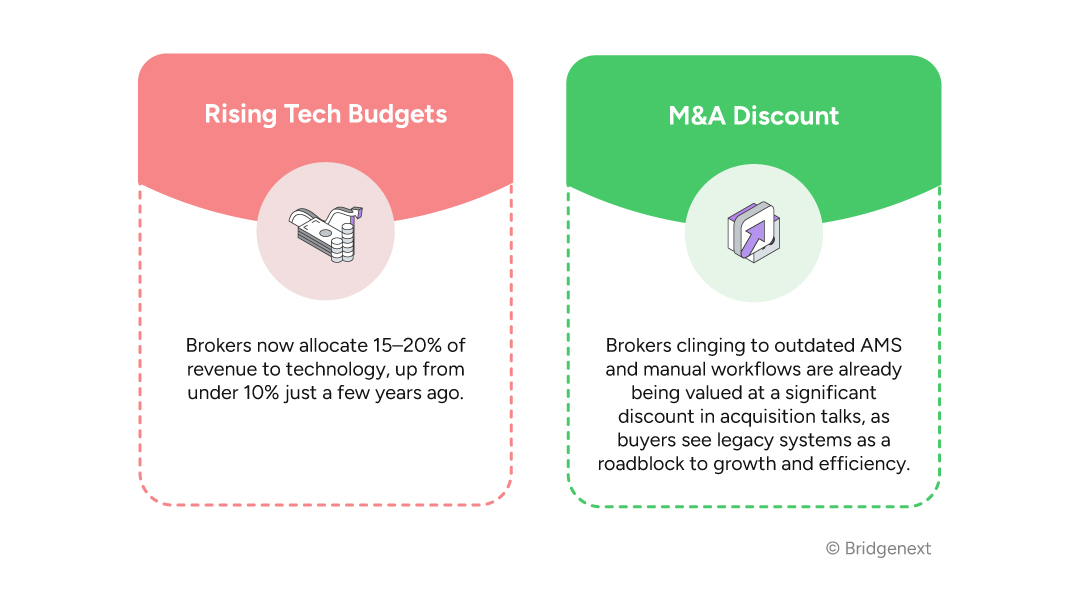

Imperative 4 – Join the Tech-Spend Arms Race

You’ve harnessed automation and AI – now it’s time to invest in the platforms that power tomorrow’s growth. Private-equity buyers consistently pay richer multiples for brokers with modern tech stacks. Case in point: tech-savvy firms are fetching up to 25% higher valuations than peers shackled to legacy systems.

Before a buyer drafts your roadmap, draft your own three-year digital cap-ex plan. Prioritize AMS modernization, carrier API integrations for straight-through processing, and hiring or partnering for analytics talent. This proactive roadmap not only safeguards margins but signals to carriers, clients, and investors that your brokerage is built for scale, not just survival.

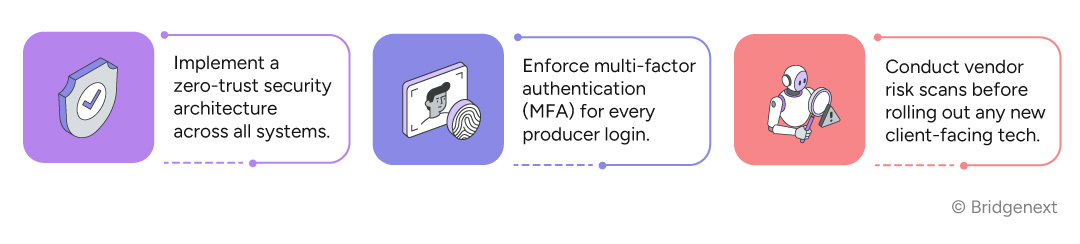

Imperative 5 – Cement Digital Trust with Cyber-Grade Defenses

You’ve built the tech—now protect it and the trust it enables. For brokers, trust is everything: one ransomware hit can freeze your book and vaporize goodwill. Even one breach can undo years of hard-earned credibility overnight.

In 2025, Verizon’s Data Breach report found that ransomware was involved in 88% of breaches at small-to-medium businesses. Meanwhile, client RFPs are increasingly demanding SOC 2 or ISO 27001 security proof — fail once, and you’re out before the finals. In an industry judged by cyber-credentials, proving SOC 2 or ISO 27001 compliance can make the difference between winning a big account and getting eliminated early.

To safeguard your digital transformation, embed these best practices:

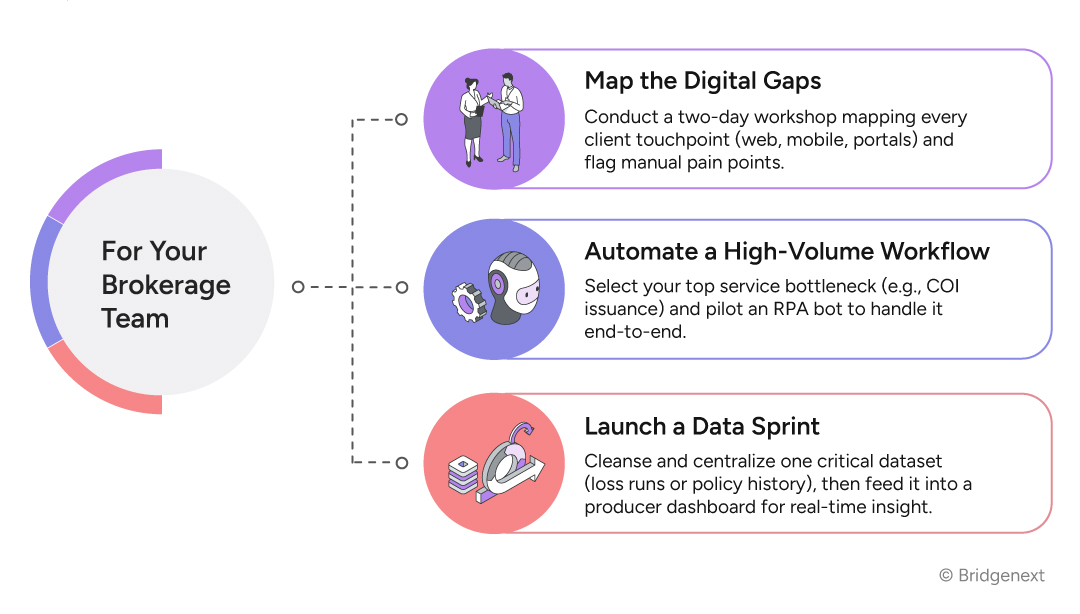

The 90-Day Digital Momentum Plan

With your cyber defenses locked in, it’s time to turn strategy into action. Here’s a 90-day playbook to generate momentum without waiting for a year-long rollout:

For Your Brokerage Team

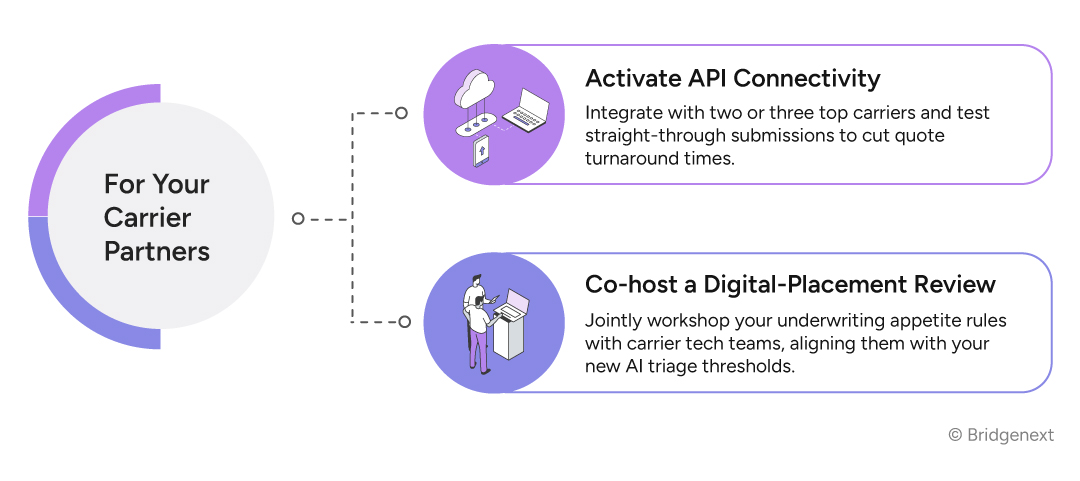

For Your Carrier Partners

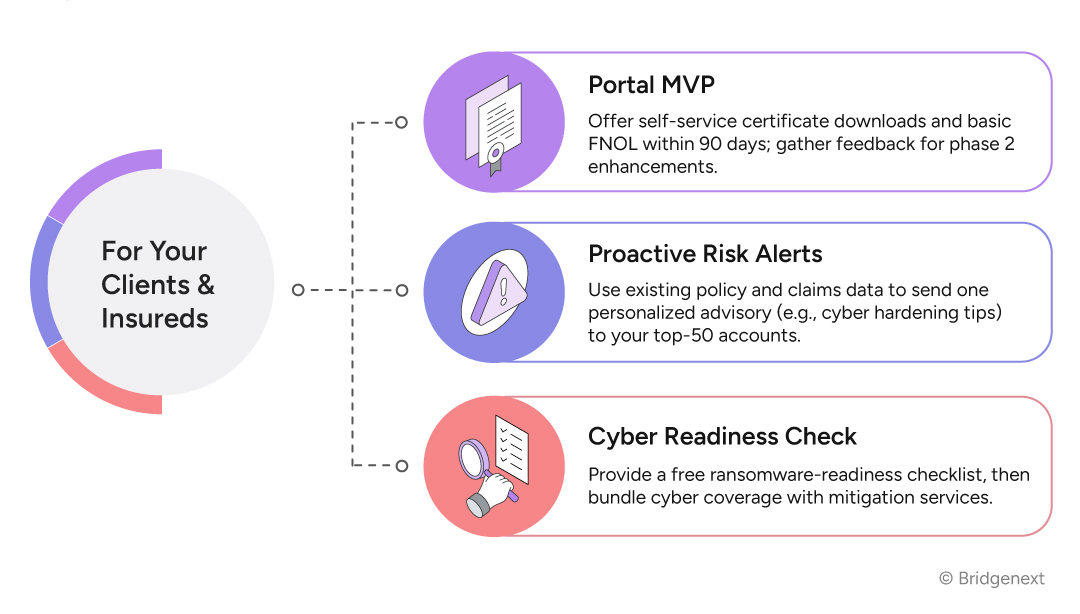

For Your Clients & Insureds

Result – These sprints create momentum, early ROI, and real client value, transforming theory into practice while showcasing quick wins to leadership and investors.

Conclusion

With 67% of insurers accelerating digital transformation, mid-sized P&C insurance brokers must follow suit or risk being left behind. Leverage automation and AI for quick wins and momentum, and underpin your growth with a strategic digital capex roadmap and strong cybersecurity to scale confidently.

Our proprietary Digital Assessment Scorecard provides an ideal starting point. Take the first step—request your scorecard to begin charting a resilient digital transformation roadmap today.

Connect with us to see how your brokerage stacks up—and which “next best step” delivers the fastest ROI.

References –

1. www.jdpower.com/business/press-releases/2025-us-insurance-digital-experience-study

2. www.feathery.io/blog/32-insurance-digital-transformation-trends

3. riskandinsurance.com/insurance-industry-faces-rising-third-party-cybersecurity-risks/

4. insuranceasia.com/insurance/news/8-in-10-insurers-plan-increase-tech-investment-year/

5. www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

6. www.mckinsey.com/industries/financial-services/our-insights/pursuing-insurance-growth-in-latin-america

7. www.bcg.com/publications/2025/how-insurers-can-supercharge-strategy-with-artificial-intelligence/