Challenge / Goal

A digital-only bank built at the cusp of technological advancement and banking expertise desired a premium digital experience for their customers through consistent and high-quality web/mobile apps and technical upgrades. To achieve these aims, the company needed to overcome challenges including:

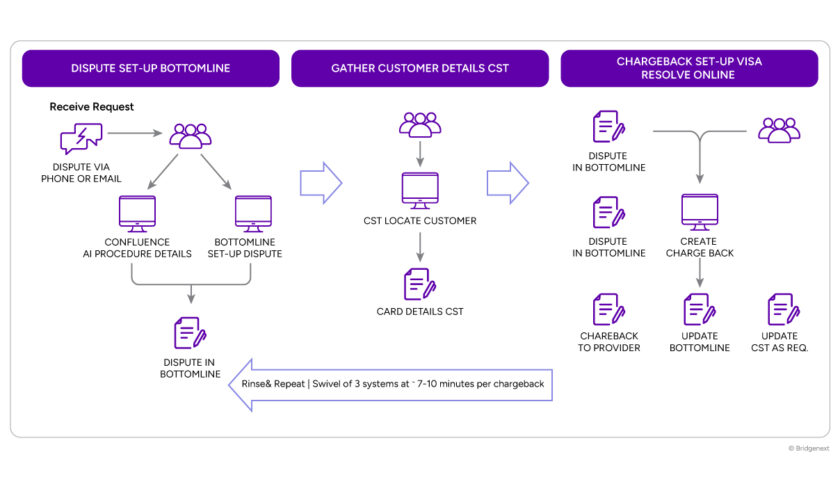

- An intensely manual, error-prone dispute chargeback process related to thousands of debit and credit card payment disputes

- Disputes received from numerous methods including calls and emails

- Agents needing to manually check customer accounts to verify listed transactions and determine the next action for each dispute

- A heavy amount of manual comparison work which led to potential inaccuracy in work queues

- The need for reminders and other tools were required to ensure alignment across the dispute team

Solution

To resolve these challenges, the intelligent automation experts at Bridgenext (formerly Emtec Digital) leveraged robotic process automation (RPA) to eliminate manual effort in the dispute chargeback process. The automated solution significantly reduces the number of steps required to navigate between systems, accelerating dispute resolution times and providing a better customer and employee experience.

Tech Stack

- UiPath

Results

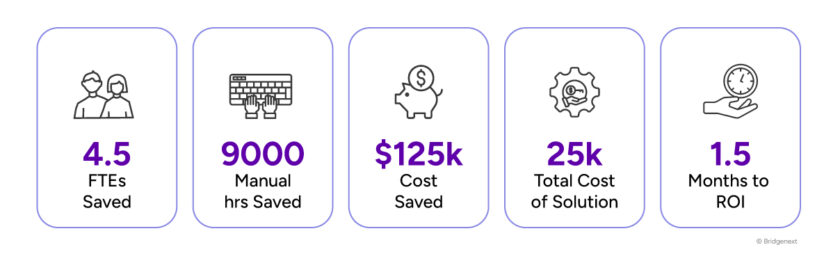

- Dispute resolution time is drastically improved, eliminating the previous 20- to 30-day chargeback backlog and improving the customer experience

- Reduced risk of manual data entry errors in internal enterprise applications through APIs and consistent notes

- Faster processing with a ~75% reduced time to resolution per chargeback (i.e., from 7 minutes to 1.5 minutes)

- Increased productivity with analysts able to spend more time on higher value-add activities versus administrative tasks

- Reduced operational cost given the ability to redeploy existing resources and avoid hiring additional resources for improved chargeback rates (<120)