09.17.25 By Kathy Kelleher

Most insurance leaders navigate a constant balancing act: maintain current operations or allocate budgets to launch new products; resolve today’s process bottlenecks or invest in future-ready capabilities. Daily, you’re managing manual reconciliations, sluggish rating updates, and compliance demands—all while striving toward long-term goals like faster product launches, enhanced customer experiences, and a platform that enables data-driven underwriting. It’s no surprise that approximately 74% of insurers still rely on systems built for a paper-based era, with most IT budgets consumed by maintenance.

Consider this blog your executive briefing. We’ll uncover the real trade-offs, highlight common pitfalls to avoid, and outline actionable starting points that deliver quick wins. If these challenges resonate, the eBook ‘Legacy System Modernization Isn’t Just a Tech Upgrade’ offers the in-depth tools you need—assessment frameworks, ROI templates, and a step-by-step pilot plan—to turn decisions into action. Read on to explore the critical questions every P&C leader should be asking.

Framing the right questions is just the beginning. The real challenge lies in identifying where insurers often falter and understanding what distinguishes stalled projects from successful ones.

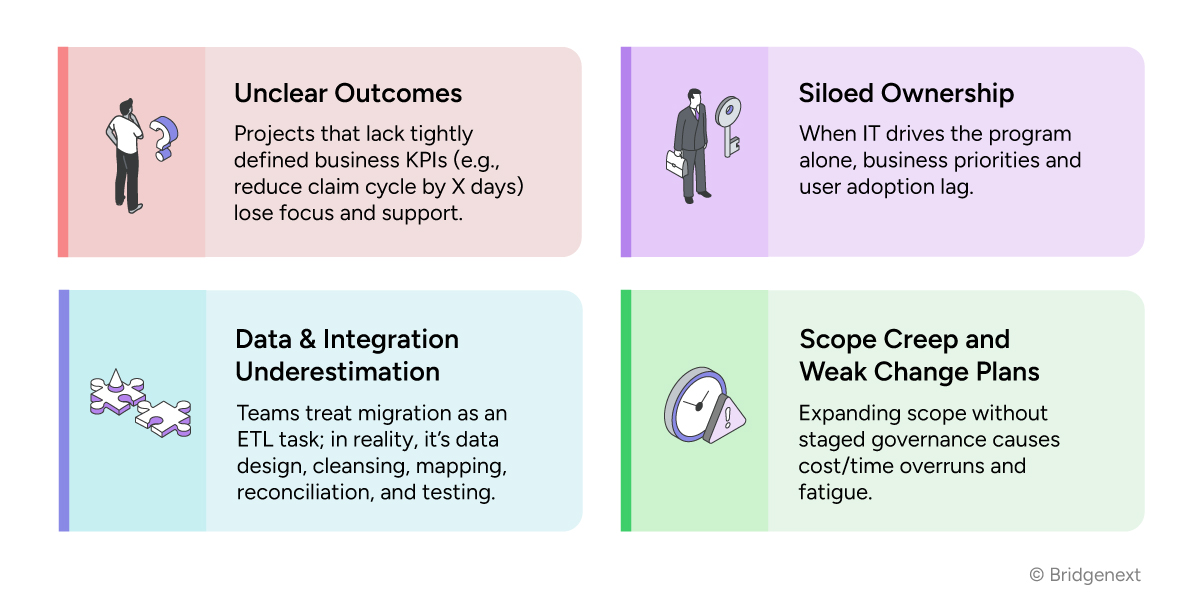

Modernization efforts often stall when goals are unclear, data requirements are underestimated, ownership is fragmented, and scope creep goes unchecked. Avoid derailment by being aware of these common stumbling blocks.

For a practical checklist to identify these traps early, the eBook provides a concise set of governance and data readiness checks to review before committing.

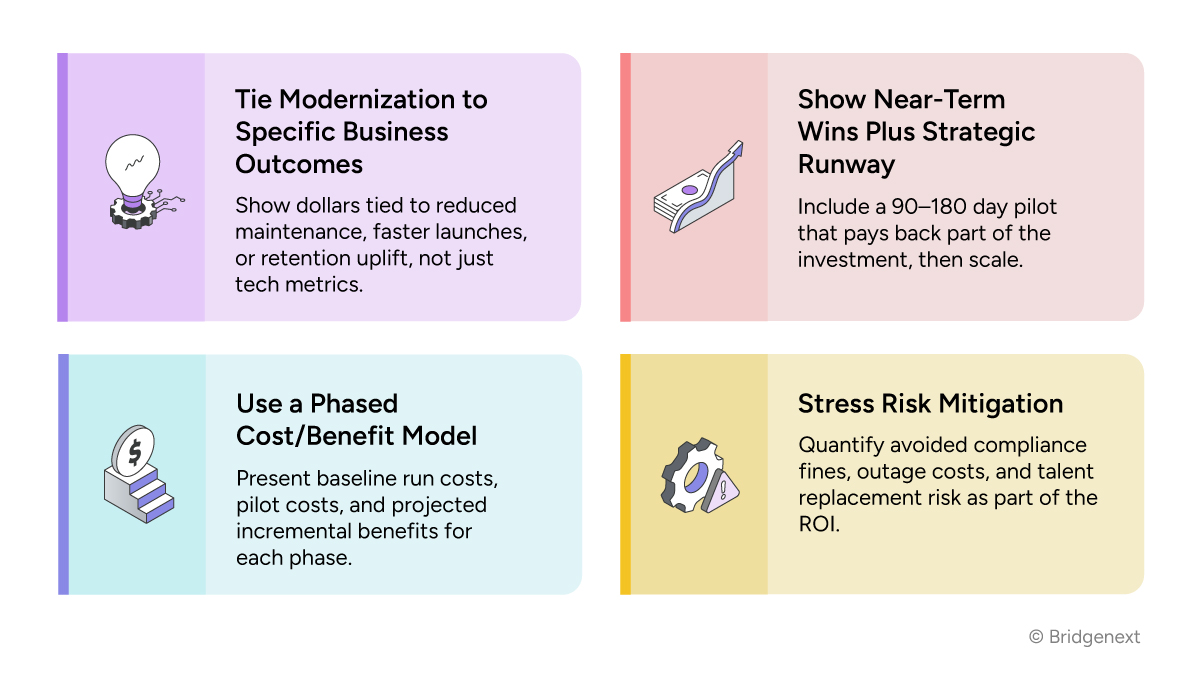

Securing board approval requires more than technical justification; it requires a clear connection between modernization efforts and measurable business outcomes. A phased ROI narrative, highlighting early wins, risk mitigation, and tangible payback, creates a compelling case.

If you need an ROI template and a phased model to present to CFOs, the guide provides a ready spreadsheet and narrative structure.

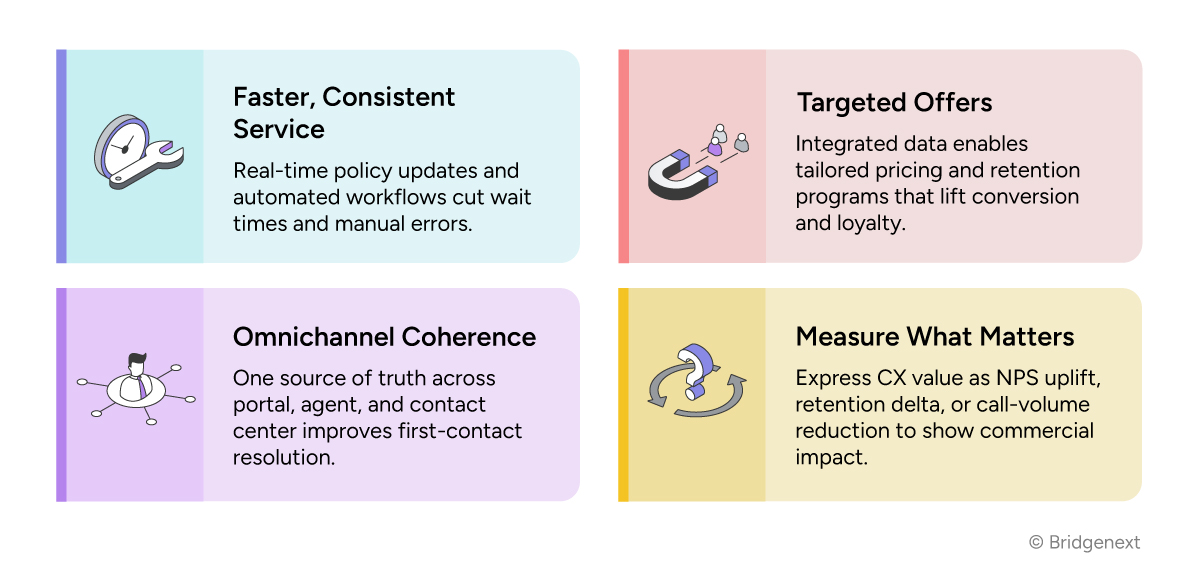

Modernization transforms the customer experience into a measurable growth driver, delivering faster service, personalized products, and seamless engagement across all channels. These improvements directly translate into higher retention, stronger loyalty, and a distinct competitive edge.

The eBook lays out a short set of KPIs and measurement templates that you can use against an early pilot to prove CX impact.

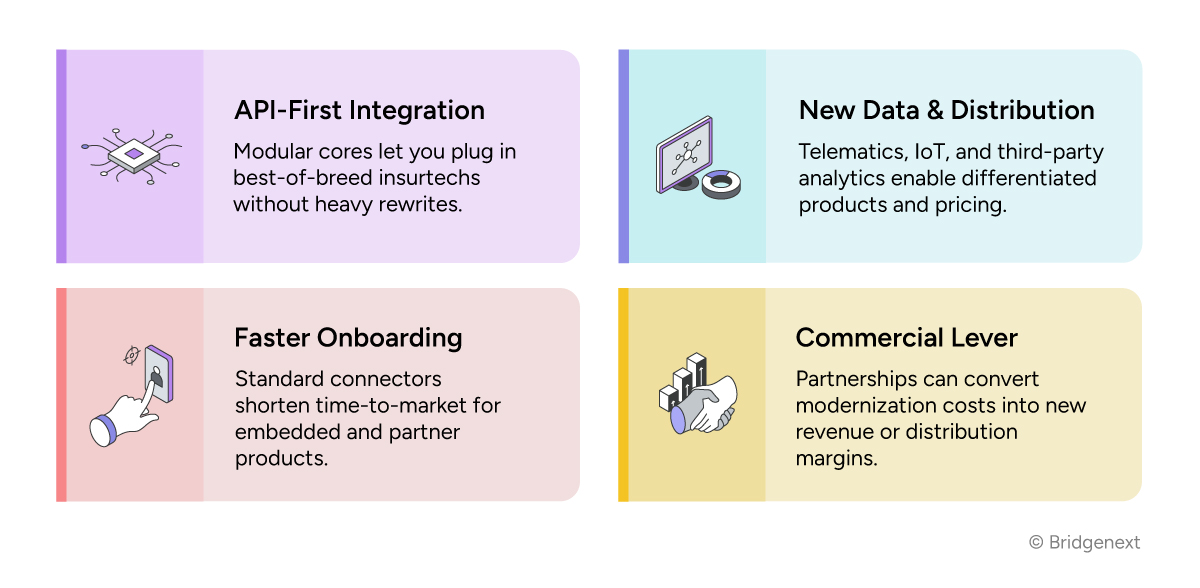

Modern cores pave the way for faster, more seamless collaboration, from API-driven insurtech plug-ins to partnerships with new data and distribution providers. The following solutions help insurers launch products faster, expand their reach, and turn integration costs into new revenue streams.

If you want templates for partner assessment and an API compatibility checklist, you’ll find them in the playbook section of the eBook.

With rising cyber threats and stringent data privacy regulations, legacy platforms create unnecessary risk. The following answers simplify cybersecurity and compliance:

The eBook includes a short checklist to assess security posture and a migration sequence that minimizes compliance exposure.

Modern systems serve as a launchpad for innovation. These answers explore how modernization establishes the foundation for IoT, blockchain, advanced analytics, and GenAI adoption, ensuring your business remains resilient amid regulatory and market shifts:

The eBook outlines a simple sandbox-to-scale blueprint you can use to pilot one emerging tech in 90 days.

See how insurers successfully managed phased migration, built organizational alignment, and delivered measurable ROI—providing practical tactics for your own transformation journey.

The eBook contains anonymized case notes and the one-page scorecard used by these teams to prioritize next moves.

These patterns distinguish programs that run endlessly from those that deliver measurable value. If these questions resonate, the next step is to conduct a focused assessment and launch a short pilot to validate the case, while keeping governance and data at the forefront.

Ready to learn more? Download the eBook today.

Schedule a call and transform your legacy systems into a growth engine for your business and stakeholders.